Virgin Island based multi-speciality hospital reduces cost-to-collect rate by 47%

The Client

The client is a multi-location, multi-specialty hospital group in the US Virgin Islands.

Business Challenges

They are a private business and the primary source of medical care on the island that also receives federal funding, yet they were struggling to break even.

They had $140 million flagged as bad debt [going as far back as 2001] and another $82 million in open AR. And despite $13 m+ going out in charges, the practice barely received 4 – 4.3 m and felt they were losing around 1-2 million every month.

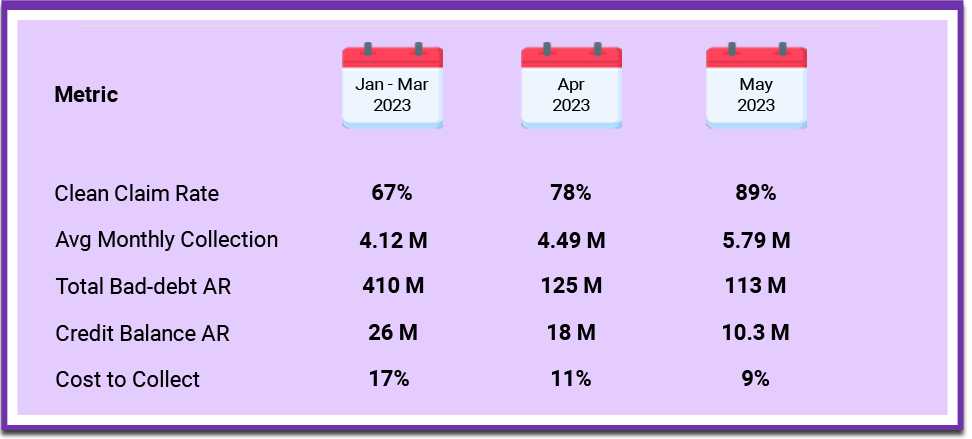

But the main challenge emerged while filing claims submissions to the insurance payers. The facility had a clean claim rate of 67%, much lower than the industry standard of 95%; it was simply quite poor. Strained with other challenges, such as limited qualified revenue cycle management (RCM) staffing and the lack of a data-driven approach, the practice lost revenue at an alarming rate, which was certainly avoidable with a few right steps.

Solutions Delivered

The client sought Jindal Healthcare’s help to streamline their medical claim cycle and improve accounts receivable (A/R) collections. Dedicated teams were set up for each RCM functions under experienced leadership to streamline operational workflows and accelerate collections. One of the first things, our experts did was to break down this complex situation into mini-challenges and employ suitable solutions.

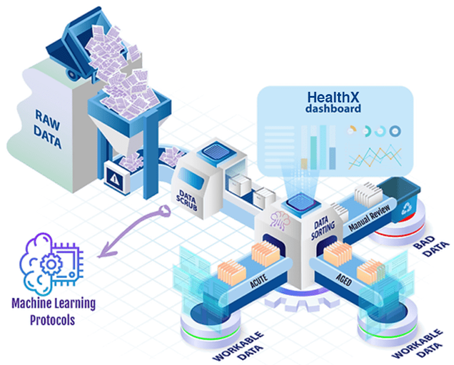

All the open A/R data was run through HealthX, an in-house proprietary AI solution, to create priority-based workflows for the AR collectors. This meant that all incoming denials and rejections were now being worked within 24-48 hrs. Our denial management experts provided intelligence on how to prevent these systemic denials, rejections and shared it with the facility.

All historic payment information was input into a data model to predict payment on future claims and time taken to receive the payment, and this information was keyed back into HealthX to make the A/R allocation even smarter. With a combination of all the above, using AI, our experts could accurately assess if the claim is potentially collectible or not, thereby allowing us to focus on what could bring in the money.

The Verification process was automated for inpatient claims. It meant that while the patient access centre still collected information during the admission even if the coverage changes when the patient was in the inpatient stay. Jindal Healthcare’s automated eligibility check reassessed and confirmed updated information right before the claims were sent. This step ensured that we bill the correct party.

All payments were previously being accepted as paid correct due to limitations in Meditech and with how the cash posting team worked. All available contracting information was put together, reviewed and entered Meditech so that incoming payments could be vetted and flagged for potential underpayment, as needed.

A separate credit balance policy and a bad debt policy revision was instated, and projects were carved out within these two to make sizeable impact.

Power BI dashboards were set up to review and track the following:

- Interim charges without any subsequent bills.

- Daily rejections – volumes and reasons.

- A breakdown of how many of these are technically avoidable.

- Daily denials – volumes and reasons.

- Services rendered by locum providers.

- Collection waterfall against projected revenues.

Outcomes

Through our analytical, data-driven and systemic RCM approach, the Virgin Island-based multi-specialty hospital group started showing good incremental growth within a quarter across aspects like claims rate, average monthly collections, etc.