Excessive revenue leakage poses a severe risk for U.S. healthcare practices presently, many already function on negative margins. A 2018 survey conducted by Fibroblast of C-suite executives in healthcare revealed an alarming rate with which hospitals lose money or fall short of their income by hundreds of millions of dollars due to revenue leakage.

What was frightening in the survey was that about 23% of respondents didn’t know the leakage costs their organizations bear. A reason directly identified with growing revenue leakages is the accounts receivable cycle.

Understanding Account Receivable and How It Impacts Reimbursements

The longer an account receivable goes unpaid, the less likely healthcare providers receive payment at all, and after crossing 120 days or 4 months, they can only expect 10 cents per dollar owed. As per the industry standards, the average account receivable days is 40, but it differs based on a multitude of factors, including the type of service or treatment rendered, insurance payer guidelines and efficacy of the medical billing cycle team. For instance, a claim without accurate medical coding services and documentation will lead to denial, delayed reimbursements, and impact the patient experience.

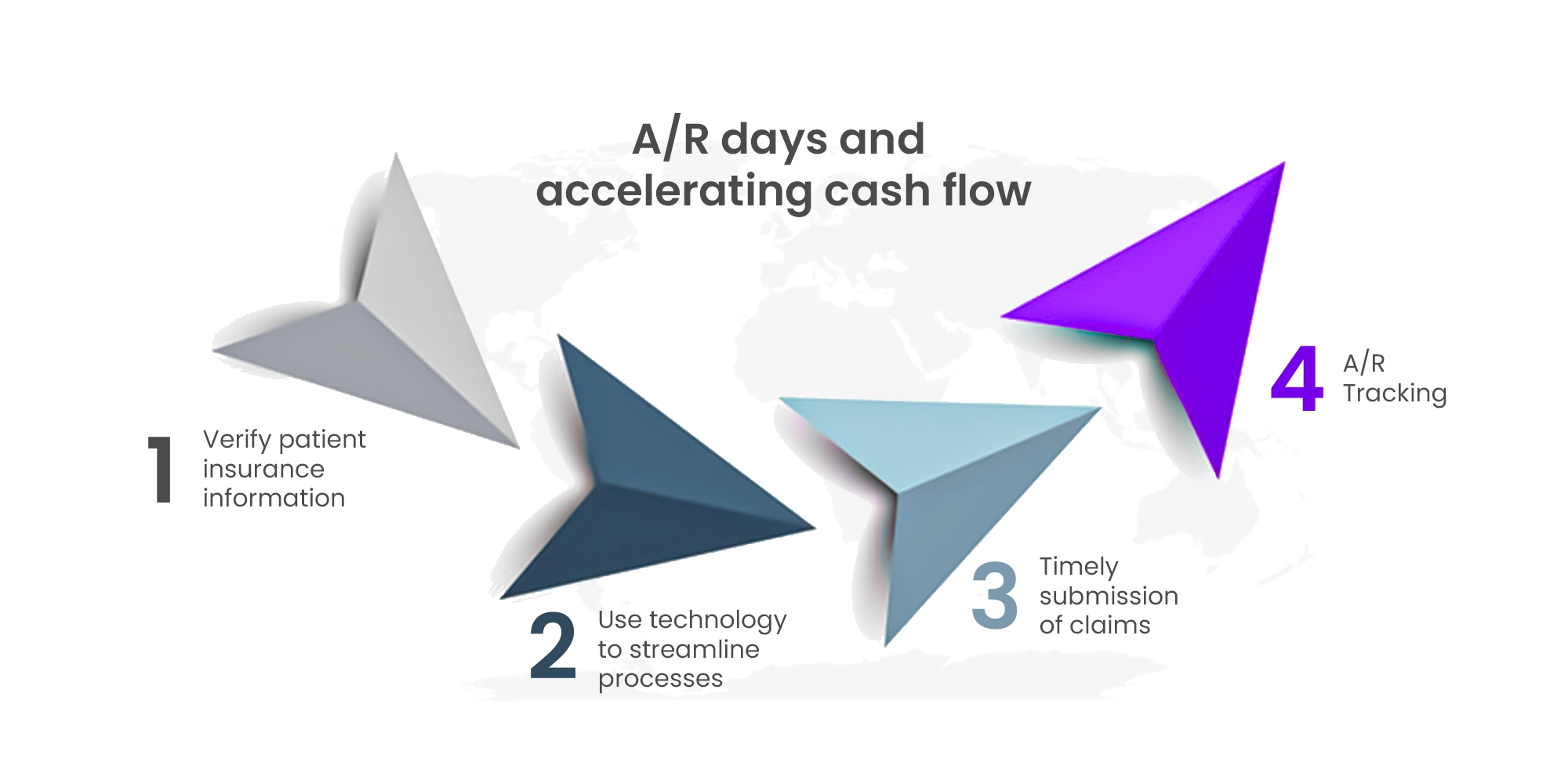

Reducing Account Receivable Days and Accelerating Cash Flow

A/R days are calculated by dividing the total A/R by the average daily charges for the practice. For example, “45 days in account receivable” means the payment is due within 45 days of work.

What are your average A/R days? If it’s between 61-120 or crossing 120 days in most cases, it’s time to consider ways to improve accounts receivable management and achieve optimal reimbursements. Follow these tips to improve your accounts receivable management and make payment collection effortless and efficient:

Verify Patient Insurance Information

One of the critical steps in account receivable management is to verify patient insurance information. Ensure that your staff verifies insurance information at every patient visit. Verify the patient’s insurance coverage and eligibility, and check for any changes in insurance plans or coverage. It is also essential to educate patients about their insurance coverage and the amount they are responsible for paying. Clear communication with patients is essential to avoid confusion or misunderstandings about their bills.

Use Technology to Streamline Processes

Technology can help streamline AR management processes. For example, we leverage our AI-based proprietary tool, HealthX, to analyze the practice’s electronic health records (EHR). This analytical data is presented through Microsoft PowerBi dashboards, visually appealing presentations that help identify claims that can be claimed easily, and which would take longer days. Ultimately, it helps reduce errors, minimize administrative tasks, and improve efficiency.

Timely Submission of Claims

Prioritize aging A/R to be processed within the TAT and ensure maximum collection. Claims should be submitted as soon as possible, preferably within 24-48 hours of the services rendered to a patient. The longer the delay in submitting claims, the more it takes for the healthcare organization to receive reimbursement from the insurance payers.

Account Receivable Tracking

It is crucial to have a process to track outstanding claims and follow up on them. Providers can compare ARs over time to identify risky trends early and determine any outstanding reimbursements that may prove easy to close. They should also analyze their AR data to determine aged debtors and collection rates. These two metrics provide an overview of providers’ AR cycles and whether they are trending in the right direction.

Learn how Pain Management Group Revenue Leaps by 30% with Streamlined Claims Filing.

Conclusion

In conclusion, Account receivable management is a critical aspect of revenue cycle management for healthcare practices. It includes several steps, like verifying patient insurance information, timely submission of claims, regular follow-up on outstanding claims, and using technology to streamline processes. Doing so requires analytical acumen and more back-end administrative staff, which increases overhead costs.

Providers can partner with an RCM company to help them with AR-related challenges, optimize costs and improve collections. Want to learn how Jindal Healthcare can help improve the financial health of your practice?